Artificial intelligence has immense potential to fundamentally alter the way financial services underwrite credit. It will not only automate manual processes but also bring accuracy, efficiency, and inclusivity into underwriting loans.

Business leaders must recognize applications of AI in underwriting for competitive advantages.

This article explains how AI can completely revolutionize the whole process of financial underwriting and gives actionable insights for enterprise decision makers.

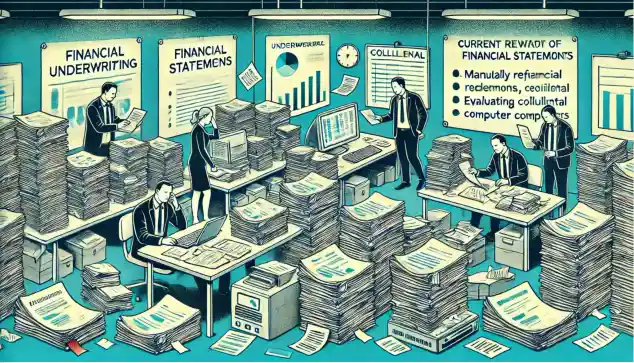

The Current State of Financial Underwriting:

The traditional financial underwriting is labor-intensive, and hence it exposes one to biases and errors of the human mind. It involves the manual collection of data from the applicant by going through large volumes of financial documents like financial statements and business plans.

After going through all the laborious steps, the underwriter makes a subjective risk assessment for the application that impacts the consistency and fairness in underwriting.

Why AI Underwriting in the Financial Domain is Important

The financial domain is fast-changing with the advent of AI, as businesses want to replace old ways of doing things with AI. Businesses are in search of new and better ways so that they can process the loans in the shortest time and using the most accurate ways to determine credit risk of borrowers.

Now it is possible for AI to parse and deconstruct the ever growing pool of big data that plagues the banks and provide, with more reliability than ever before, smaller and less critical data-driven lenders.

AI is on the way to make credit risk evaluation effective by refining operations and giving clients better service. Latest technological advancements in AI would usher in informed decision making, reduce operational costs, and help scale businesses. Now, let us dive deep into how we can automate financial underwriting steps with AI.

1. Automatic Data Collection and Entry- AI systems can easily perform this task; the important bits from the text or the document are extracted via OCR technology, using natural language processing that turns the raw data into a goldmine of decision making. It reduces overall data processing time and reduces the probability of human errors.

2. Improved Verification and Validation- AI is at the heart of verification and validation processes and can help innovate newer ways of automation with accuracy.

- ID Verification: AI systems can help identify security features in identity documents, like watermarks, holograms, etc. This will help businesses reduce their dependence on manual risk operations and prevent bad actors who may get through the KYC checks.

- Document Review: AI systems can automate the review and summarization of legal and financial documents across languages, thus opening financial underwriting to underrepresented segments of society. AI can also pinpoint anomalies in the document for further human review.

3. Collateral Evaluation- AI systems can use image recognition technology to evaluate the quality and value of collateral. The technology has potential to automate the manual appraisal process by analyzing the photos of machines or properties and then determining the costs of those things according to the current market and the systems’ analysis of their condition and use.

4. Business Plan Assessment– AI systems are clever and have near human like reasoning capabilities to analyze business plans. AI systems can extract critical information from the business plan documents and compare with that of competitors via web search. It can then compare the results with standard industry benchmarks and provide an objective risk assessment for financial underwriting.

5. Advanced Risk Assessment– AI processes and analyzes big data at scale which makes it an ideal technology for risk assessment. It looks at a company’s financial health and brings in alternative data sources like social media activity, online reviews etc. Some key financial metrics which can be automated include:

- Annual and Monthly Revenue: AI extracts revenue from financial statements for real-time reporting.

- Debt-to-Income Ratio (DTI): AI calculates DTI by comparing monthly debt payments to income, flags for human review if it goes above threshold.

- Debt-to-Asset Ratio: AI pulls data from balance sheet to calculate this ratio, tracks changes over time to show risk trends.

6. Fast Documentation and Compliance- AI can prepare underwriting documentation and ensures compliance, reducing administrative burden and compliance risk. A PwC study says AI can reduce compliance costs by 30-50%.

7. Better Customer Interaction- AI powered chatbots and virtual assistants provide real-time updates and application status to customers, improves customer experience. Accenture says AI in customer service can increase satisfaction by 20%.

These are just a few examples of how a financial lending company can gain advantages from AI technology.

The Impact: A Big Change

Adding AI to credit underwriting leads to major improvements:

- Productivity: Task automation quickens the process cutting down response times.

- Precision: AI-based analysis cuts down on human mistakes making risk assessment more exact.

- Fairness: AI looks at creditworthiness from all angles giving chances to businesses that were left out before.

To Wrap Up

Throughout my long career at big Fin tech companies like PayPal and Intuit, I’ve watched technology cause big changes. AI isn’t just a tool; it’s causing a revolution in financial underwriting. By using AI, we can do underwriting that’s quicker more exact, and fairer to everyone.