China is now the world’s biggest electric vehicle (EV) market, driven by government support, battery technology and local car makers’ rapid expansion. Walking down the streets of Wuhan, you can’t miss the EVs, with their green plates. These cars from Chinese companies like BYD, Nio, Xpeng and Leapmotor are replacing traditional gasoline cars fast, China is serious about clean energy transportation.

The growth of the EV market in China can be largely attributed to government initiatives. Since 2009, the Chinese government has invested over $231 billion in the EV sector, supporting research, development and infrastructure including setting up charging stations. This financial backing has allowed local makers to produce affordable electric vehicles, so the entry barriers for consumers are lower.

According to China Association of Automobile Manufacturers (CAAM), there were 1.68 million charging stations in China by end of 2023, a huge jump from just 1,000 in 2010.

Battery Innovation and Local Makers

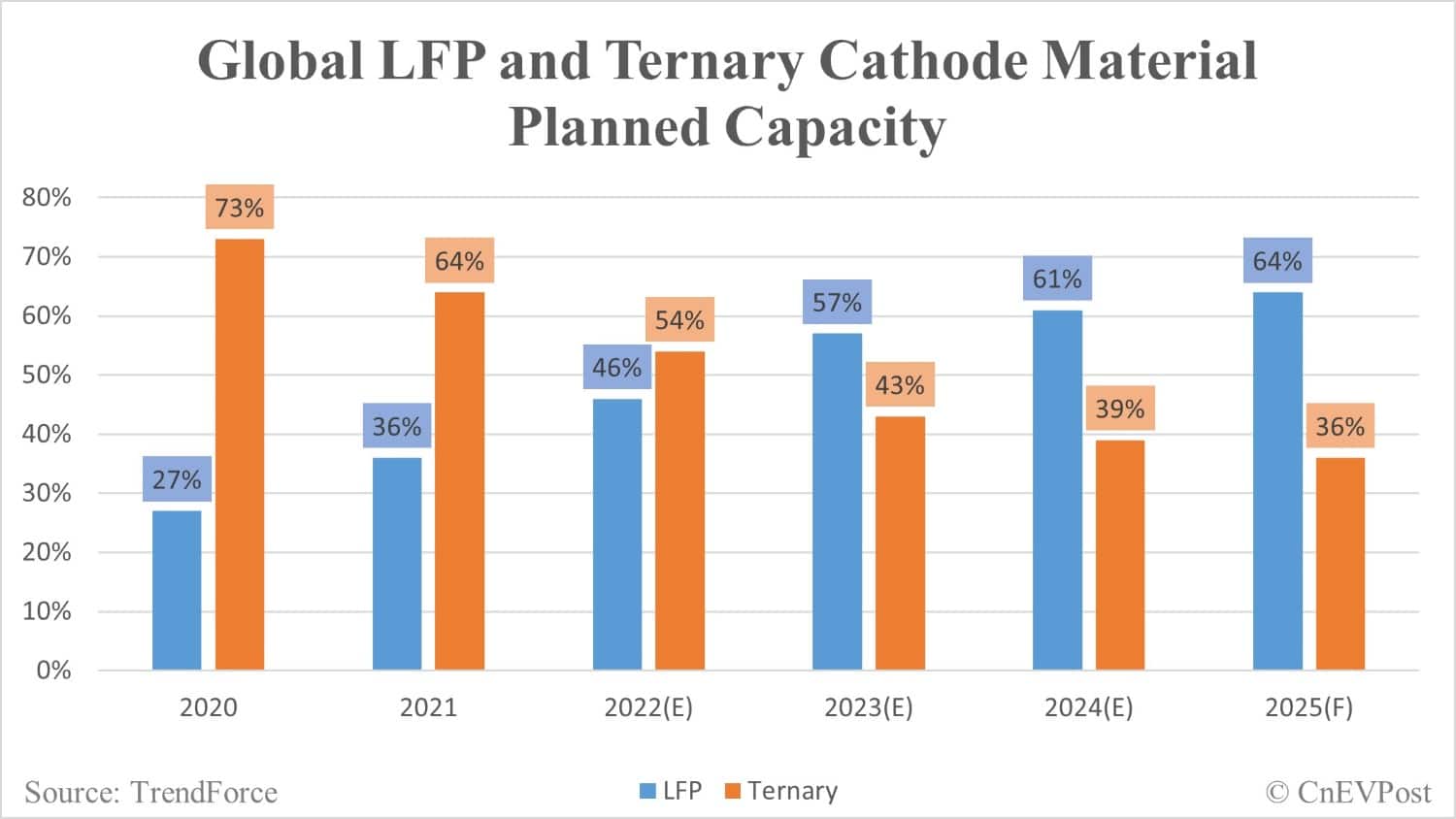

BYD for example has used its battery technology expertise to become the world’s biggest EV maker in 2023. The company’s success is largely due to its focus on lithium iron phosphate (LFP) batteries which are loved for their stability and cost. LFP batteries accounted for 60% of the total EV battery market in China in 2023, according to Trendfroce. This shift to LFP batteries has allowed Chinese makers to produce EVs at lower cost, so more consumers can get in.

In the first half of 2023, China’s cumulative EV battery production reached 293.6 GWh, up 36.8% year on year. EV battery sales were 256.5 GWh, up 17.5% year on year. China’s EV battery installation capacity also grew rapidly, reaching 152.1 GWh, up 38.1% year on year.

BYD’s lead in the EV market is evident in its market share. In 2023, BYD sold 2.7 million green cars (including EVs and hybrids), with a 35% market share in China. BYD is the only company with over 10% market share in the domestic market. BYD’s focus on LFP batteries is the key to its competitive pricing. For example, LFP batteries are about 30% cheaper than NCM batteries which are used in other EVs4.

The overall EV battery market in China is concentrated with a few big players. Contemporary Amperex Technology Co. Limited (CATL) remained the leader with 43.4% market share in the first half of 2023, followed by BYD with 29.85%. Other notable players are China Aviation Lithium Battery (CALB), EVE Energy, and Guoxuan High-Tech with 8.26%, 4.35%, and 3.98% market share respectively.

The growth of EV battery market in China is also driven by technological progress and increased production capacity. For example, CATL has been investing heavily in next-generation solid-state batteries which have higher energy density and better safety than current lithium-ion batteries5. China Electric Vehicle Battery Industry Innovation Alliance reported that the number of domestic EV battery enterprises has increased, new players like Linkage Tianyi, Tianyi Energy and Huzhou Weilan Technology have entered the market.

Tesla has been selling EVs in China since 2014 and is facing increasing competition from local brands. Chinese makers not only offer cars at competitive prices – some as low as $10,000 – but also advanced technologies like software updates and battery-swapping services pioneered by Nio. The average price of an EV in China was $30,000 in 2023, vs $55,000 in the US. This price competitiveness is a major reason for the fast adoption of EVs in China.

Market Size and Forecast

The domestic EV market is still strong. With 10 million EVs expected to be sold in 2024, China’s position won’t be dethroned anytime soon. According to International Energy Agency (IEA), China accounted for 57% of global EV sales in 2023, up from 41% in 2020. IEA expects China to remain the leader in the global EV market, with 15 million units by 2030.

2023 saw a huge growth in EV sales in China, 8.4 million units sold, 35% year on year. This was driven by government incentives, battery tech advancements and consumer awareness of environmental issues. The Chinese government’s EV purchase subsidies, up to $7,000 per vehicle, has been a key factor in making EVs more affordable to consumers.

EVs market share in China has also grown a lot. 2023 EVs accounted for 30% of all new car sales in the country, up from 25% in 2022. This will continue, EVs will reach 40% of market share by 2025. The fast growth of EV in China is also shown by the number of EV models available in the market. As of 2023 there are over 300 EV models available to Chinese consumers, up from 100 in 2018.

The growth of EV in China is also seen in the charging infrastructure. By the end of 2023 China had over 2.5 million public charging points, up 50% from the previous year. This massive network of charging stations has eliminated range anxiety and made EVs more practical for long distance travel. The Chinese government has set a target to have 4 million public charging points by 2025.

Chinese EV makers are also doing well in the global market. 2023 Chinese companies exported 1.2 million EVs, 60% up from 2022. Europe has become a key market for Chinese EV exports, Chinese brands have 10% market share in the region. Chinese EVs competitive pricing and advanced tech has made them attractive to European consumers.

IEA forecast for global EV market also shows China’s dominance. By 2030 IEA expects global EV sales to reach 40 million units, China will account for 37.5% of that. This is because of China’s all-round approach to EV ecosystem, investment in battery tech, manufacturing capacity and charging infrastructure.

Challenges and Geopolitics

But China’s EV growth isn’t without its problems. Trade tensions with Western countries have slapped tariffs on Chinese EVs in key markets like the US and Europe, complicating the global plans of Chinese car makers. In 2023 the EU imposed a provisional anti-subsidy tariff of up to 37.6% on Chinese EVs, citing state subsidies and unfair competition. This followed an anti-subsidy investigation launched by the European Commission in October 2023. The US increased tariffs on Chinese EVs from 25% to 100% in May 2024, due to ongoing concerns about China’s trade practices2. Canada raised its import tariff on Chinese EVs from 6.1% to 100% in August 2024.

These geopolitics have complicated the global plans of Chinese EV makers. But the domestic market is still a safe haven for Chinese makers. In 2023 China exported 1.2 million EVs, a 60% increase from the previous year3. Europe has become a key market for these exports, with Chinese brands taking 10% of the market. Chinese EVs are competitive and techy so European consumers love them.

Environment and Sustainability

China’s EV boom also has an environmental impact and worth talking about. According to a report by the Ministry of Ecology and Environment, the widespread use of EVs in China saw 120 million tons of CO2 emissions reduction in 2023 alone. That’s equivalent to the annual emissions of 30 coal fired power plants. The Chinese government has set a target to be carbon neutral by 2060. The transition to electric vehicles is a key part of that plan.

Besides reducing CO2 emissions, the shift to EVs has also improved air quality in urban areas. The Ministry of Ecology and Environment reported a 15% decrease in PM2.5 in major cities in 2023 compared to 2022. That’s a big public health benefit, reducing respiratory and cardiovascular diseases.

The government is still supporting the EV industry through various policies. In 2023 the government extended tax exemption for EV purchases and subsidies for home charging station installation. These have helped to sustain the growth of the EV market and get more consumers to switch to electric vehicles.

EV adoption gets even more environmental benefits from battery recycling and second-life applications. CATL and BYD are building battery recycling facilities to recover lithium, cobalt and nickel. That reduces the environmental impact of battery production and contributes to the circular economy.

Technological Advancements

Chinese EV makers are the leaders in technology, especially in autonomous driving and AI. Xpeng and Nio are pouring big money into these areas. According to a McKinsey & Company report, Chinese EV makers filed over 5,000 autonomous driving patents in 2023, more than any other country. This will drive more growth.

Xpeng for example has made big progress in autonomous driving. In 2023 it launched the Xpeng P7 with the XPILOT 3.5 system which has advanced driver assistance features like lane centering, adaptive cruise control and auto parking. The XPILOT 3.5 system uses liDar, radar and cameras to have high situational awareness and safety.

Nio another big player in the Chinese EV market has also been investing heavily in autonomous driving and AI. In 2023 Nio launched its NIO Pilot system which has highway pilot, traffic jam pilot and auto lane change. Nio has also been developing its own AI assistant NOMI which uses natural language processing to communicate with drivers and provide real time information and assistance.

Autonomous driving is not limited to passenger cars. Chinese companies are also exploring autonomous commercial vehicles. In 2023 BYD partnered with Baidu to develop autonomous buses and trucks to improve logistics efficiency and reduce transportation costs. This shows the broader impact of autonomous driving on the economy.

Global Impact

Industry experts say China’s experience can be a model for other countries to speed up their EV transition. According to a Bain & Company report, China’s EV production knowhow can help other countries develop more affordable and efficient energy solutions. The report says China’s focus on battery and infrastructure is the key to its success and can be replicated in other markets.

China’s battery technology, especially the development of lithium iron phosphate (LFP) battery, has set the standard for the global EV industry. The cost and stability of LFP battery has made it a favorite among many manufacturers. In 2023 LFP battery accounted for 60% of the total EV battery market in China. This technological advantage has allowed Chinese makers to produce affordable EVs and make them more accessible to the mass market.

The global impact of China’s EV market leadership goes beyond technology and production. China’s vast EV charging infrastructure, with over 2.5 million public charging points by the end of 2023, is a model for other countries. The Chinese government’s support for charging networks has reduced range anxiety and made EVs more viable for long distance travel.