Neo-banking, the digital disruptor that emerged from the ashes of the financial crisis, has swiftly transformed into a global juggernaut, rewriting the rules of the financial game. Brace yourself for an exploration into this digital revolution, where Alexey Averin, an experienced professional in fintech, digital transformation and neobanking with over 10 years of experience takes us for a deep dive into the factors propelling neo-banking’s rise, the strategies that set them apart, and the challenges they must conquer.

The Rise of Neo-Banking: A Phenomenon to Watch

Neo-Banking isn’t just a trend; it’s a phenomenon that’s gaining momentum with astonishing speed.

The global customer base of neobanks has grown from 2 million to 15 million in just three years, and the number of neobanks has increased from around 70 to over 250. The market size of neo and challenger banks was estimated at more than 47 billion U.S. dollars in 2021, which grew to 66.8 billion U.S. dollars in 2022 as per Statista.

According to Statista Market Forecast, the transaction value in the Neobanking market is projected to reach US$5tn in 2023. The transaction value is expected to show an annual growth rate (CAGR 2023-2027) of 18.16%, resulting in a projected total amount of US$9tn by 2027. The average transaction value per user in the Neobanking market amounts to US$19.8k in 2023. From a global comparison perspective, it is shown that the highest transaction value is reached in the United States (US$1,426bn in 2023).

This growth rate is nothing short of remarkable. This meteoric rise begs the question: What exactly is Neo-Banking, and why is it capturing the attention of millions?

Neo-Banking: Beyond the Conventional

Neo-Banks, also known as digital banks or challenger banks, are a breed apart from their traditional counterparts. They’re not confined to brick-and-mortar establishments or complicated bureaucratic processes. Instead, Neo-Banks operate exclusively online, leveraging cutting-edge technology to provide a seamless and user-friendly banking experience. From account opening to money management, everything is a few taps away on your smartphone.

These digital-first platforms analyze your spending habits, savings goals, and financial aspirations to offer you tailored solutions. Budgeting becomes a breeze with real-time insights into your transactions and expenses. Plus, with features like instant peer-to-peer transfers, fee-free international transactions, and sleek mobile apps, neobanks are setting a new standard for convenience and cost-effectiveness.

But there’s more beneath the surface. Neobanks often collaborate with fintech partners to offer a diverse range of services. From investment options to microloans, the neobanking ecosystem is expanding rapidly. At its core, neobanking offers a seamless digital banking experience that’s more intuitive, efficient, and personalized.

Financial inclusion has long been a global challenge, with millions of individuals lacking access to basic banking services. Neo-Banking is emerging as a game-changer in this arena. With their low entry barriers and minimal documentation requirements, Neo-Banks are reaching the unbanked and underbanked populations, empowering them with the tools they need to participate in the modern economy.

The emerging trend of neo-banking

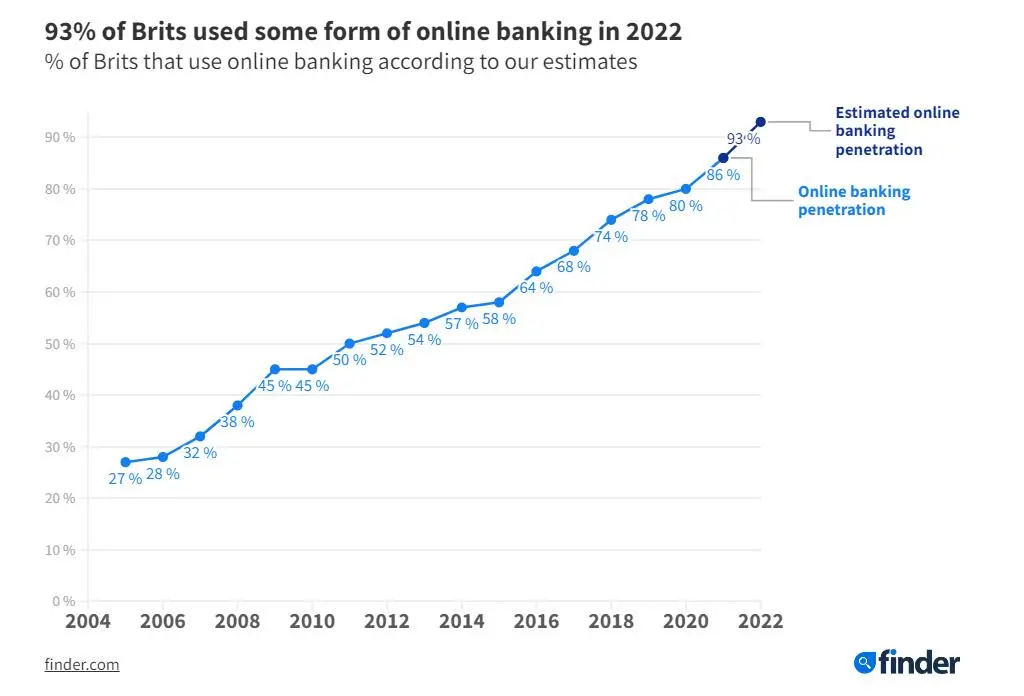

Neobanks gained prominence in the late 2000s after the financial crisis, with global regulators encouraging their growth to boost competition in the banking sector. Since then we have been observing the growing popularity of neobanking, which was also accelerated by the COVID-19 pandemic as evidenced by the research “Fintech in the time of COVID−19: Technological adoption during crises“. As a result, nowadays we observe neobanking as one of the fastest-growing fintech industries worldwide. The increasing inclination towards online banking usage indicates that as individuals become more familiar with conducting banking activities through the internet and mobile devices, they are increasingly open to adopting banks that operate exclusively in the digital realm in the times ahead.

The countries with the most neobanks are France, Germany, Italy, Netherlands, and Spain.

Neo-Banking: The Swift Ascendance

Numbers don’t lie, and the numbers speak volumes. We’re witnessing nothing short of a financial renaissance, with neo-banking emerging as one of the fastest-growing sectors in the fintech universe. Global Market Insights forecasts a staggering 45% compound annual growth rate (CAGR) spanning from 2022 to 2028. Let that sink in. By 2028, the market’s value is poised to eclipse the astounding $600 billion milestone. Neo-banking’s swift rise isn’t just a statistic; it’s a testament to an industry that’s disrupting the traditional banking establishment.

How neobanks conquer users worldwide:

The driving force behind neobanks’ global triumph is rooted in a fundamental distinction from their traditional counterparts. Neo-banks have embraced a distinct set of features that differentiates them from the traditional banking landscape.

Neobanks has adopted the following features compared to traditional banks:

Customer-Centricity at Its Core:

One of the most striking features of Neo-Banking is its unwavering commitment to the customer. Traditional banks have often been criticized for their convoluted fee structures, lack of transparency, and sluggish response times. Neo-Banks, on the other hand, put the customer first. They offer simplified fee structures, real-time transaction notifications, and responsive customer support that’s available around the clock.

AI-powered risk assessment:

Neobanks utilize AI and Machine Learning algorithms to craft tailored approaches, elevate customer interactions, and reduce the potential for unauthorized transactions. Moreover, these digital banks harness sophisticated technologies to pinpoint questionable behaviors, adeptly identifying fraudulent transactions through the recognition of deviations from standard customer patterns. Most neobanks explore the integration of Big Data for compliance purposes.As a result, trust in the services provided by these firms is boosted, leading more and more people to choose neobanks as their preferred option.

The pace of introducing new technologies:

According to McKinsey research, “While a typical bank could take years to launch a new product, neobanks with an AI-first mindset do it in months, sometimes even weeks”. The reason for this is that neobanks are highly focused on product development, making substantial investments in their engineers and developers team. They establish comprehensive teams consisting of members from various domains, such as product owners, designers, data scientists, along with participants from legal, risk, operations, and marketing departments. In contrast, traditional banks have not traditionally adopted such an approach to integrating new technologies and often rely on outsourcing resources.

Higher standards of data protection and tailored customer experience:

Neobanks employ cloud services for data management, leading to increased efficiency, and reinforce their security with strong firewalls to safeguard against cybercriminals and malicious entities. Despite traditional banks potentially having larger customer bases, the undeniable ascent of digital banking institutions is reshaping the financial scenario.

Digitalized approach to the work with the client:

Traditional banks have physical branches for in-person banking services, while neo-banks operate digitally through mobile apps and websites, without any physical branches. Traditional banks typically have time-consuming and paperwork-intensive account opening procedures that require multiple visits and verifications. In contrast, neo-banks offer a streamlined and quick online account opening process, utilizing advanced identity verification technology.

Even when traditional banks employ digital technologies, they still do not reach sufficient user satisfaction: “Among traditional banks, though, only 52 percent permitted digital onboarding—meaning that nearly half require new customers to visit a local office to fulfill signup requirements. Of the ones that do offer digital onboarding, 80 percent provided an experience that we deemed inadequate.” – Fourthline

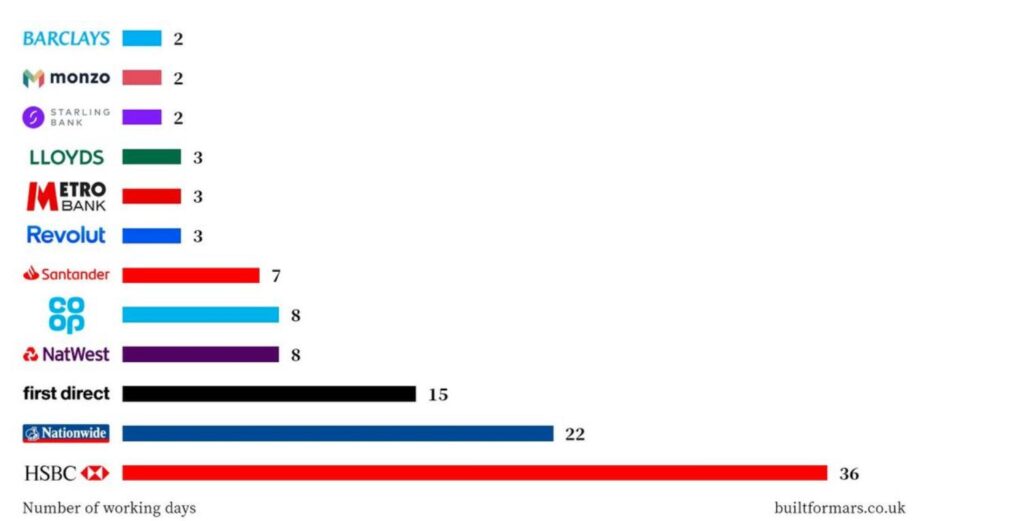

Another study reveals that neobanks are way more efficient when it comes to opening a bank account. This graph shows findings on how many working days it took to open a fully functioning bank account with each provider: “As you’d expect, the challenger banks were considerably faster than the more traditional banks”

The future of neobanks and the challenges which they need to address

In spite of the notable technological progress that neobanks are known for, this industry faces various challenges that could potentially impact their performance. One of the major concerns is cyber attacks, with banking apps being a common target for viruses and malware infiltration. According to cybersecurity researchers at ThreatFabric over 300,000 Android smartphone users have downloaded what turned out to be banking trojans. And these malwares can be very tricky, as the initial download appears to be free of any harmful content. However, users are later urged to install an update that cleverly masquerades as a collection of new fitness routines. Sadly, this deceptive update is, in fact, the means through which the harmful payload is distributed.

Amidst neo-banking’s ascent, a shadow looms large—cybersecurity threats. Banking apps have become prime targets for malevolent actors, and neo-banks are no exception. With over 300,000 Android users unwittingly downloading banking trojans, the stakes are high. It’s a battle that demands not just attention, but strategic action.

Drawing from my expertise, I recommend implementing the following steps and procedures to combat cybersecurity threats effectively:

- Allocate a substantial portion of the budget to compliance and cybersecurity teams, ensuring at least 10% of the budget is dedicated to research and development in this field.

- Assemble a specialized team to diligently monitor and scrutinize clone applications on app stores and other platforms, thereby identifying and addressing potential security risks.

- Regularly inform users about the risks associated with cybersecurity and upcoming events related to their accounts or data. Encourage their active involvement in safeguarding their personal information.

The Road Ahead: Neo-Banking’s Evolution

As Neo-Banking continues to reshape finance, its evolution is far from over. We can expect to see even greater integration with emerging technologies like blockchain and the Internet of Things (IoT). Furthermore, partnerships between Neo-Banks and fintech companies are on the rise, promising a seamless ecosystem of financial services that cater to every aspect of modern life.

The fusion of fintech and innovation lies at the core of neobanking’s success.

With the ongoing expansion and evolution of the neobank industry, the unfolding future will determine if it can effectively supplant the traditional brick-and-mortar banks that have dominated the financial realm for centuries. The pivotal factor in this assessment remains the financial dimension. Nonetheless, it’s imperative not to overlook the threat posed by cyber attacks, given their direct impact on user loyalty and the acquisition of essential licenses.

In conclusion, Neo-Banking isn’t just a fleeting trend; it’s a transformative force that’s turning the financial industry on its head. With its customer-centric approach, technological innovation, and commitment to financial inclusion, Neo-Banking is set to become a cornerstone of the future financial landscape. As traditional banks struggle to keep up, Neo-Banking continues to surge ahead, reshaping finance at warp speed.

About the Author: Alexey Averin

Alexey Averin is an experienced professional in fintech, digital transformation, and neobanking with over 10 years of experience. He is currently working as the Head of Digital Channel Development (B2C / B2B) at Sinara Bank and previously served BCS Bank and Russian Standard Bank too.